New Jersey Real Estate Exit Tax . 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a state tax return. — if you’re considering selling your home in new jersey and moving out of state, you should familiarize yourself with the nj exit tax and. — exemption no. — the new jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: to guard against new jersey real estate sellers leaving town and not paying tax owed on a gain realized upon sale, the new. — in this video, we'll dive into the ins and outs of the new jersey exit tax. — the new jersey exit tax is a real estate transfer fee imposed on sellers leaving the state.

from esign.com

1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a state tax return. — the new jersey exit tax is a real estate transfer fee imposed on sellers leaving the state. — if you’re considering selling your home in new jersey and moving out of state, you should familiarize yourself with the nj exit tax and. to guard against new jersey real estate sellers leaving town and not paying tax owed on a gain realized upon sale, the new. — in this video, we'll dive into the ins and outs of the new jersey exit tax. — exemption no. — the new jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price:

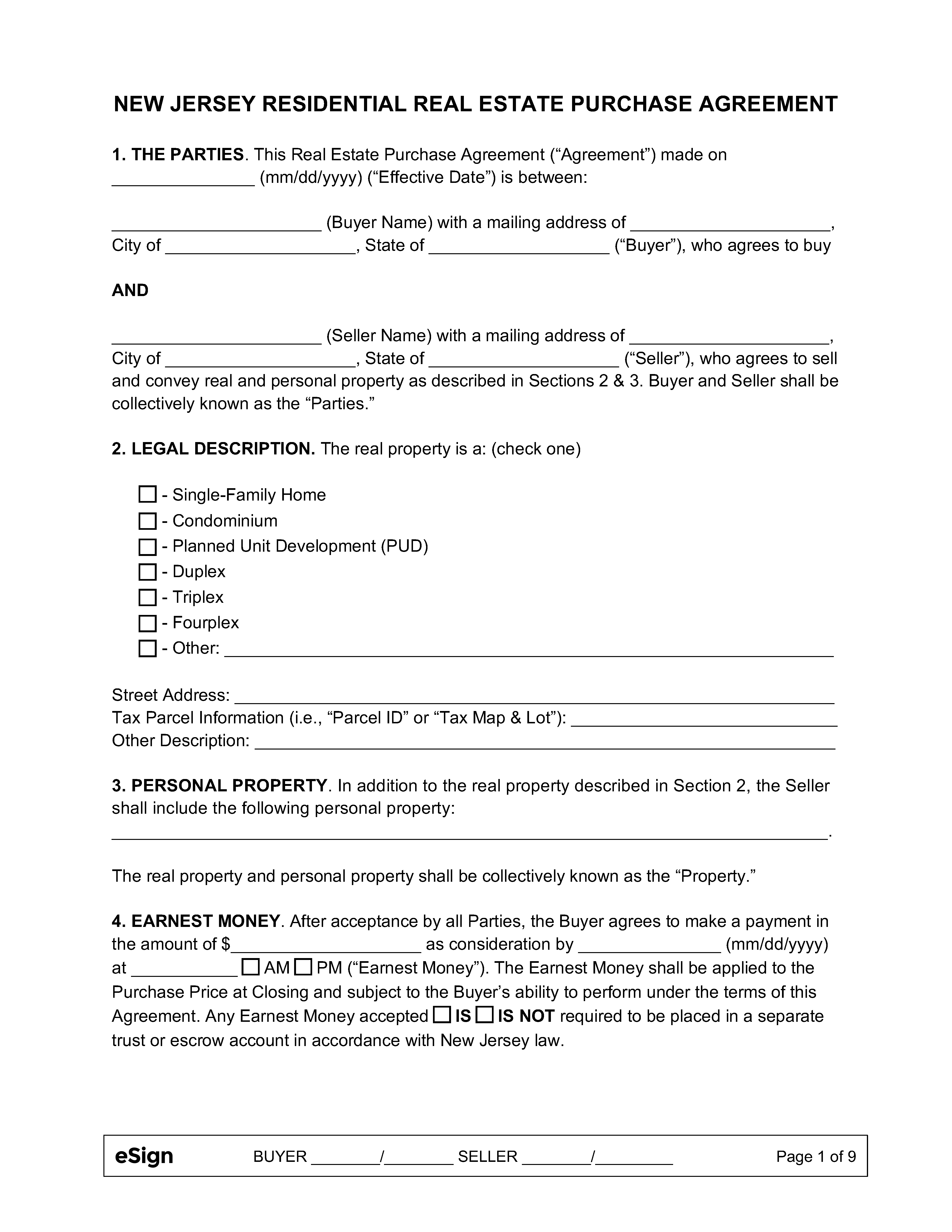

Free New Jersey Residential Purchase and Sale Agreement PDF Word

New Jersey Real Estate Exit Tax 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a state tax return. — in this video, we'll dive into the ins and outs of the new jersey exit tax. — if you’re considering selling your home in new jersey and moving out of state, you should familiarize yourself with the nj exit tax and. to guard against new jersey real estate sellers leaving town and not paying tax owed on a gain realized upon sale, the new. 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a state tax return. — the new jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: — the new jersey exit tax is a real estate transfer fee imposed on sellers leaving the state. — exemption no.

From activerain.com

The New Jersey Realty Transfer Fee vs. the New Jersey Exit Tax New Jersey Real Estate Exit Tax — the new jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: — in this video, we'll dive into the ins and outs of the new jersey exit tax. to guard against new jersey real estate. New Jersey Real Estate Exit Tax.

From www.njpp.org

Why Significant, Lasting Property Tax Reform is So Difficult New New Jersey Real Estate Exit Tax 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a state tax return. — in this video, we'll dive into the ins and outs of the new jersey exit tax. — exemption no. — if you’re considering selling your home in new jersey and. New Jersey Real Estate Exit Tax.

From www.njpp.org

Fast Facts In Every County, Very Few New Jerseyans Owe Estate Tax New Jersey Real Estate Exit Tax — exemption no. — the new jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on. New Jersey Real Estate Exit Tax.

From njmoneyhelp.com

What the “exit tax” really means for a home sale in New Jersey New Jersey Real Estate Exit Tax 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a state tax return. — the new jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price:. New Jersey Real Estate Exit Tax.

From esign.com

Free New Jersey Residential Purchase and Sale Agreement PDF Word New Jersey Real Estate Exit Tax — exemption no. — the new jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: — if you’re considering selling your home in new jersey and moving out of state, you should familiarize yourself with the. New Jersey Real Estate Exit Tax.

From www.christiesrealestate.com

New Jersey Real Estate and Apartments for Sale Christie's New Jersey Real Estate Exit Tax — in this video, we'll dive into the ins and outs of the new jersey exit tax. — the new jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: — the new jersey exit tax is. New Jersey Real Estate Exit Tax.

From njrereport.com

Where will Trump’s tax policy hurt most in NJ New Jersey Real Estate New Jersey Real Estate Exit Tax — if you’re considering selling your home in new jersey and moving out of state, you should familiarize yourself with the nj exit tax and. 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a state tax return. — exemption no. — the new. New Jersey Real Estate Exit Tax.

From www.abnewswire.com

New Jersey Real Estate Attorney Christine Matus Unveils Insights on the New Jersey Real Estate Exit Tax — exemption no. — in this video, we'll dive into the ins and outs of the new jersey exit tax. — if you’re considering selling your home in new jersey and moving out of state, you should familiarize yourself with the nj exit tax and. to guard against new jersey real estate sellers leaving town and. New Jersey Real Estate Exit Tax.

From esign.com

Free New Jersey Real Estate Listing Agreement PDF Word New Jersey Real Estate Exit Tax 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a state tax return. — the new jersey exit tax is a real estate transfer fee imposed on sellers leaving the state. — exemption no. to guard against new jersey real estate sellers leaving town. New Jersey Real Estate Exit Tax.

From realestateexamninja.com

The Ultimate Guide To Getting Your Real Estate License In New Jersey New Jersey Real Estate Exit Tax — in this video, we'll dive into the ins and outs of the new jersey exit tax. to guard against new jersey real estate sellers leaving town and not paying tax owed on a gain realized upon sale, the new. — exemption no. — the new jersey exit tax is a real estate transfer fee imposed. New Jersey Real Estate Exit Tax.

From www.goodreads.com

Essentials of New Jersey Real Estate, 16th Edition Includes the latest New Jersey Real Estate Exit Tax — in this video, we'll dive into the ins and outs of the new jersey exit tax. — the new jersey exit tax is a real estate transfer fee imposed on sellers leaving the state. 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a. New Jersey Real Estate Exit Tax.

From www.njspotlightnews.org

Interactive Map Tracking Results of PropertyTax Uptick Across NJ NJ New Jersey Real Estate Exit Tax — the new jersey exit tax is a real estate transfer fee imposed on sellers leaving the state. 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a state tax return. — if you’re considering selling your home in new jersey and moving out of. New Jersey Real Estate Exit Tax.

From gwynethstuart.blogspot.com

nj property tax relief check 2021 Stuart New Jersey Real Estate Exit Tax 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a state tax return. to guard against new jersey real estate sellers leaving town and not paying tax owed on a gain realized upon sale, the new. — if you’re considering selling your home in new. New Jersey Real Estate Exit Tax.

From www.nj.com

I sold my house. How can I get a refund of the exit tax? New Jersey Real Estate Exit Tax — the new jersey exit tax is a real estate transfer fee imposed on sellers leaving the state. — exemption no. to guard against new jersey real estate sellers leaving town and not paying tax owed on a gain realized upon sale, the new. — if you’re considering selling your home in new jersey and moving. New Jersey Real Estate Exit Tax.

From eforms.com

Free New Jersey Real Estate Agent Listing Agreement PDF Word eForms New Jersey Real Estate Exit Tax — exemption no. — the new jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: to guard against new jersey real estate sellers leaving town and not paying tax owed on a gain realized upon sale,. New Jersey Real Estate Exit Tax.

From www.formsbank.com

Form ItEp State Of New Jersey Division Of Taxation Inheritance And New Jersey Real Estate Exit Tax 1 applies to new jersey residents and says that all applicable taxes on the gain from the sale will be reported on a state tax return. — the new jersey exit tax is a real estate transfer fee imposed on sellers leaving the state. to guard against new jersey real estate sellers leaving town and not paying tax. New Jersey Real Estate Exit Tax.

From budbuyshomes.com

The New Jersey Real Estate Market is Still Booming! A Quick Look Into New Jersey Real Estate Exit Tax — the new jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: — in this video, we'll dive into the ins and outs of the new jersey exit tax. — if you’re considering selling your home. New Jersey Real Estate Exit Tax.

From esign.com

Free New Jersey Real Estate Listing Agreement PDF Word New Jersey Real Estate Exit Tax — exemption no. — in this video, we'll dive into the ins and outs of the new jersey exit tax. — the new jersey exit tax is a real estate transfer fee imposed on sellers leaving the state. — if you’re considering selling your home in new jersey and moving out of state, you should familiarize. New Jersey Real Estate Exit Tax.